Share

Share

Print

Print

The 'LABOR' J/E Expenditure Class is produced by adding manual labor to a Work Order.

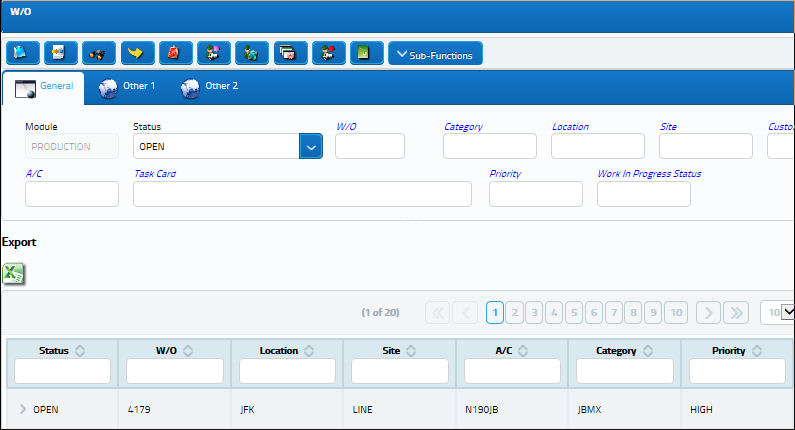

For example, find the correct Work Order then select the Labor Manual ![]() button from the W/O header window.

button from the W/O header window.

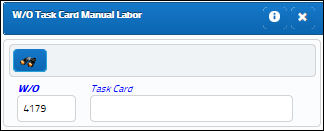

When the W/O Task Card Manual Labor window appears, the W/O field is populated. Select the Find ![]() button to enter information.

button to enter information.

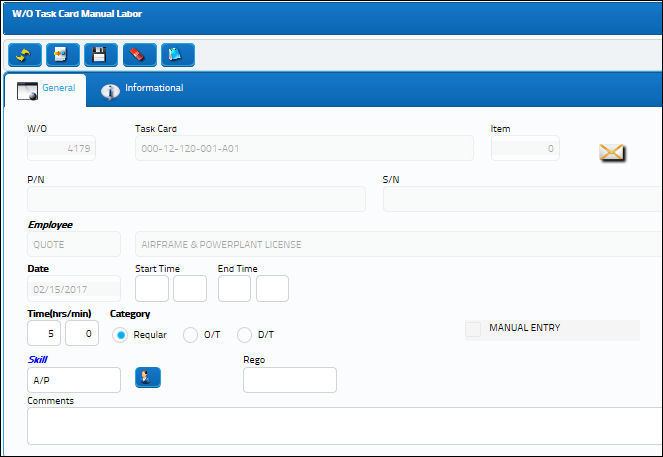

In the detail window add all relevant information then save.

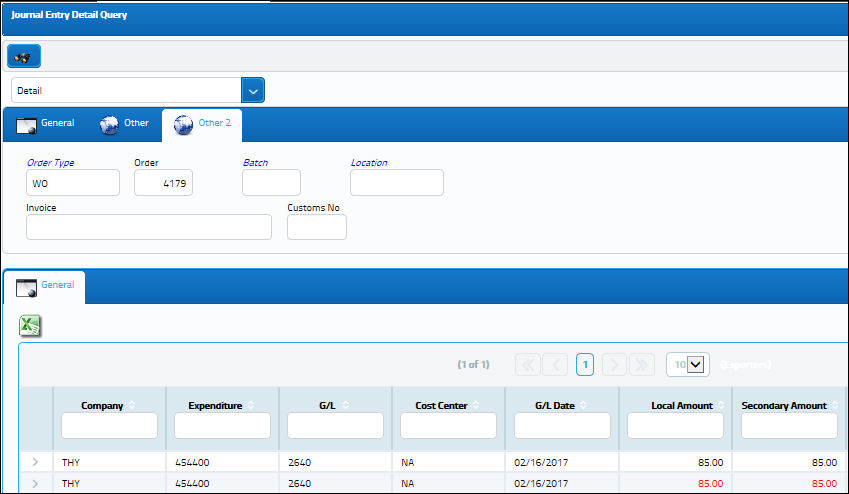

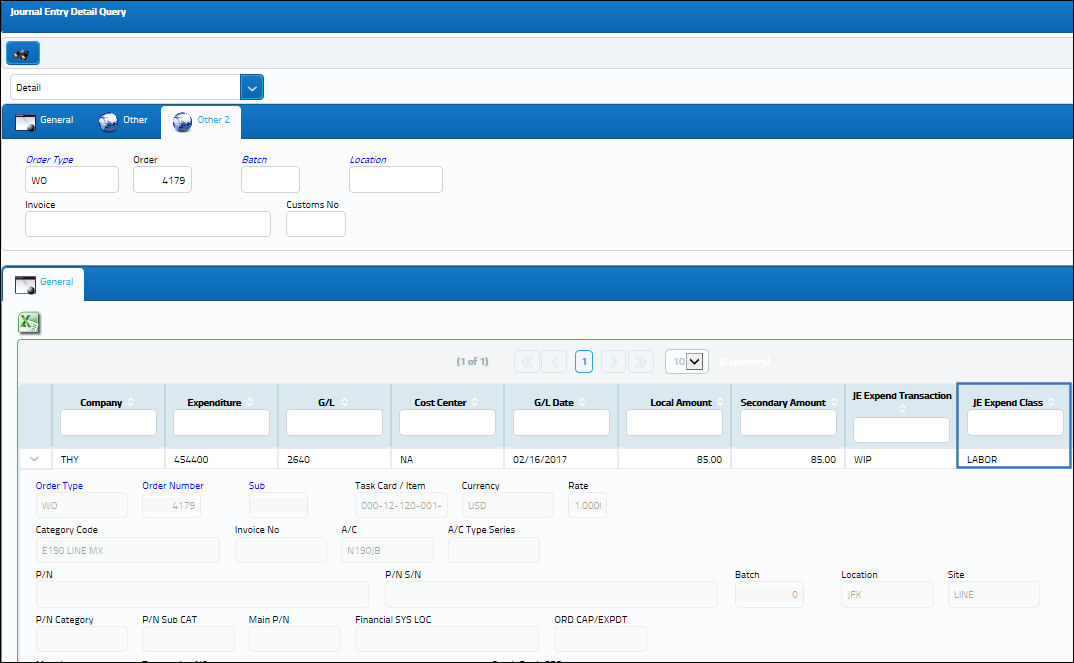

From the Journal Entry Detail Query window users can see the adjustments against the G/L.

Note: The costs associated to this labor charge are based on the Skill level of the employee required to perform the manual labor. In this example the Skill level is 'TECHNICIAN'. These fees are set up via the Settings/Update/Skill master window's Cost/Sell tab.

Notice the J/E Expenditure Class field reads 'LABOR'.

Note: The above screenshot has been altered to highlight the relevant columns for this example.

For more information regarding adding manual labor to a Work Order, refer to the topic Labor Manual Button via the Production manual.

Work Order Closing:

The reverse of the Work In Progress 'LABOR' Journal Entry takes place during the Work Order Closing process. The charges associated to the G/L are reverted into the 'EXPENSE' account.

Note: The above screenshot has been altered to highlight the relevant columns for this example.

For more information refer to the topics Work Order Closing and Work Order Closing Post Completion via the Production manual.

Third Party Work Order:

For a Third Party Work Order, create a W/O with the Third Party checkbox selected.

After saving, the Customer Orders window will appear. Enter all relevant information.

From the W/O Sell tab, enter the Contract Number for the previously created Customer Contract. Select the Save ![]() button to save.

button to save.

From the Work Order header window, find the W/O and select the Labor Mnl ![]() button.

button.

The W/O field is auto-populated. Choose a previously attached W/O Task Card then select the Find ![]() button.

button.

When the detail window appears, add all relevant information then save.

From the Journal Entry Detail Query window users can see the adjustments against the G/L.

For more information regarding Third Party Work Orders and Customer Contracts, refer to the topics Third Party Button and Customer Contract via the Production manual.

Third Party Work Order Closing:

Through the Work Order Closing process the Labor fee is charged against the 'SALES' and 'ACCOUNTS RECEIVABLE' accounts. Both charges are then added and revered into the 'COST OF SALES' account. (See notes at the bottom of the topic.)

Note: The amount of the Labor charge against the G/L is comprised of the Sell Amount listed in the Customer Contract and the amount of the Manual Labor hours entered into the W/O Task Card Manual Labor window. (In this example, 5 hours of labor multiplied by a Sell Amount of 50.00 equals a charge of 250.00. When the 'SALES' and 'AR' accounts are added together the sum of 500.00 is reversed into the 'COST OF SALES' account.)

From the Journal Entry Detail Query window users can see the adjustments against the G/L.

For more information on the closing of a Work Order, refer to the topics Work Order Closing and Work Order Closing Post Completion via the Production manual.

Note: Refer to G/L Interface Switch ![]() JETPWSAL for more information regarding the Accounts Receivable account. When set to Yes, the AR account will NOT be charged at Third Party W/O Closing. When set to No (as in the examples above), the AR account is charged. Users must also perform the Customer Invoice Authorization. For more information refer to the topic Customer Invoice Authorization via the Production manual.

JETPWSAL for more information regarding the Accounts Receivable account. When set to Yes, the AR account will NOT be charged at Third Party W/O Closing. When set to No (as in the examples above), the AR account is charged. Users must also perform the Customer Invoice Authorization. For more information refer to the topic Customer Invoice Authorization via the Production manual.

Share

Share

Print

Print