Share

Share

Print

Print

Third Party Work Orders

Note: The other VAT Expenditure Classes (Labor VAT, Material VAT, Misc VAT, Order VAT) follow the same process as the Flat Rate VAT.

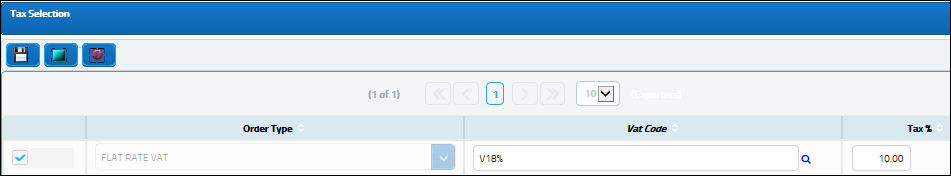

Create a Customer Contract with the Flat Rate VAT sub category:

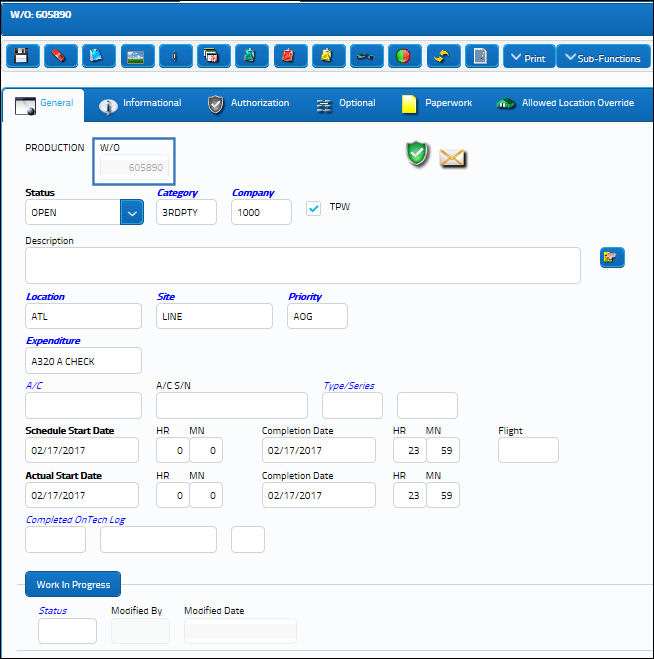

Create a Third Party Work Order:

Link the Contract to the Work Order:

The Work Order Actuals display the correct amount for the INVOICE FLAT RATE and FLAT VAT:

The Work Order has been closed:

The Flat Rate VAT appears in the Customer Invoice Authorization Invoice window where the invoice is authorized:

From the Journal Entry Detail Query window users can see the adjustments against the G/L:

Share

Share

Print

Print