Share

Share

Print

Print

Configuring Expenditure Codes

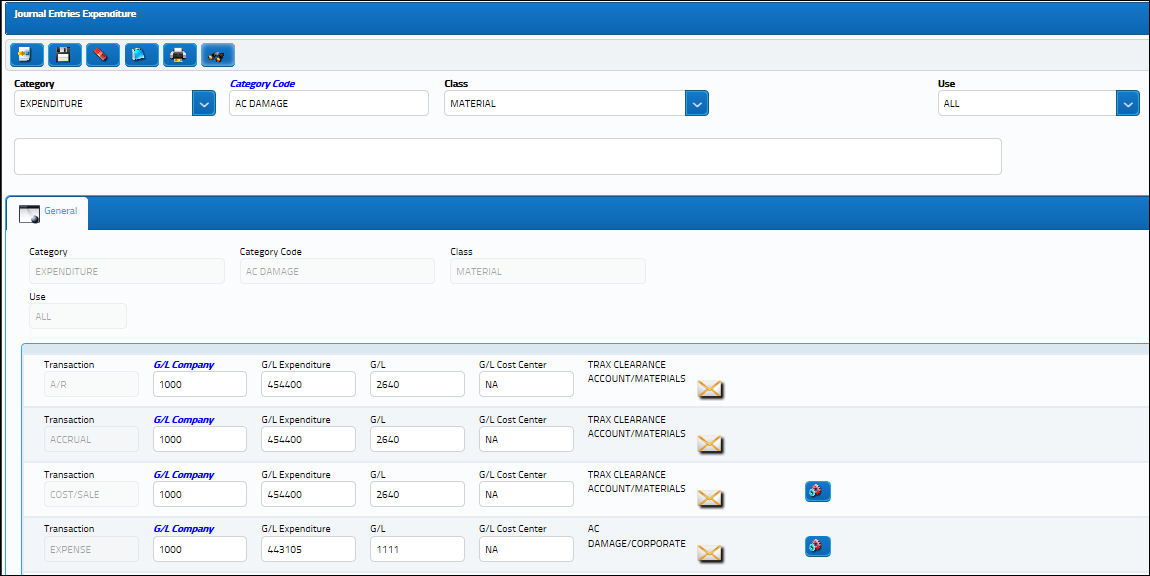

Expenditure codes are used on Work Orders and Customer Orders (sales) to specify the accounts to which costs are booked. When items are transacted against Work Orders (or Customer Orders), the Journal Entries will be created according to the Expenditure code set up for the item.

These codes need to be set-up by the users to facilitate correct financial posting through the Journal Entries for any items relating to expenditure. At least one expenditure code will need to be created to operate the system (with the mandatory Labor class). Failure to set up accounts for an Expenditure code will result in G/L postings to account 0000-0000-0000-0000.

Note: The Class and Use fields automatically display when the Expenditure Category is selected.

The following information/options are available in this window:

_____________________________________________________________________________________

WIP

Work In Progress - For tracking expenses while the W/O is in progress. After closing the W/O, balance is transferred to expense account.

Expense

For Accounting the expenses related to a Work Order.

Sales

Used to account for the total sale amount of a sales transaction.

Cost of Sales

For Third Party Items - for accounting the cost of items sold when used on a sales transaction.

Accrual

Accrual account - used to accrue expenses (post closing).

A/R

Account Receivable - used when a sales transaction is associated with this expenditure code.

_____________________________________________________________________________________

![]() Accrual accounts pertain only to Labor transactions while WIP accounts pertain only to Material transactions.

Accrual accounts pertain only to Labor transactions while WIP accounts pertain only to Material transactions.

Note: Users can change the G/L accounts that are associated with a Journal Entry Expenditure Category/ Category Code combination that is already in the system by clicking on the Category Code field. The list of pre-defined Category Codes will appear to choose from.

The following information/options are available in this window:

_____________________________________________________________________________________

Class

The class of transaction booked to a Work Order (or Customer Order). Options are described as follows:

Duty - For applicable duty fees on a Work Order. Takes place when an order with a Duty Cost is attached to a Work Order then received into inventory. A Duty charge will only appear in the G/L if it is attached to a Work Order through an Exchange Order, Repair Order or Service Order.

Exchange Order - Exchange Orders on the system. Takes place when an Exchange Order with an Exchange Fee is attached to a Work Order then received into inventory.

Flat Rate Labor - Flat-rated labor fee for third party maintenance. Takes place when a Third Party Work Order is attached to a Customer Contract that is a 'Labor Flat' category and has a Sell Amount. The transaction occurs when manual labor is added to a Work Order. The Flat Rate charge will appear against the G/L when the Third Party Work Order is closed.

Flat Rate Material - Flat-rated material fee for third party maintenance. Takes place when a Third Party Work Order is attached to a Customer Contract that is a 'Material Flat' category and has a Sell Amount. The transaction occurs by creating a Manual Issue for a P/N. The Flat Rate Material charge will appear against the G/L when the Third Party Work Order is closed.

Flat Rate VAT - Flat Rate VAT tax for Flat-rated fee for third party maintenance. Takes place when a Third Party Work Order is attached to a Customer Contract that is a 'Labor Flat' category and has a Sell Amount. The transaction occurs when manual labor is added to a Work Order. The Flat Rate charge will appear against the G/L when the Third Party Work Order is closed.

Freight - For applicable freight charges on a Work Order. Takes place when an order with a Freight Cost is attached to a Work Order then received into inventory. A Freight charge will only appear in the G/L if it is attached to a work Order through an Exchange Order, Repair Order or Service Order.

Invoice Flat Rate - Invoice Flat Rate for Third Party maintenance. Takes place when a Third Party Work Order is attached to a Customer Contract to capture miscellaneous invoice processing fees.

Labor - For actual (hourly) labor rates applied to a Task Card through a Work Order (could also be Third Party).

Labor VAT - Labor VAT tax for actual (hourly) labor rates applied to a Task Card through a Work Order (could also be Third Party).

Material - For actual (issued) material with an associated cost on Work Orders (Third Party also).

Material VAT - Material VAT tax for actual (issued) material with an associated cost on Work Orders (Third Party also).

Misc VAT - Miscellaneous VAT tax

Miscellaneous - Takes place when miscellaneous charges are added to a Work Order through the Addbill function.

Order VAT - Order VAT tax for Normal (repair, service) costs booked to work orders. Takes place when a Repair Order with a Unit Cost is attached to a Work Order then received into inventory.

Quoted Flat Rate - All Material and Labor Actuals for Quoted routine Task Cards are included in the Quoted Flat Rate. Additional Non-Routine Task Cards that are not covered under the Flat Rate will then capture the Actuals. Task Cards that fall under the Quoted Flat Rate are still listed on the final invoice but with a value of 0.00.

Repair Order - Normal repair costs booked to work orders. Takes place when a Repair Order with a Unit Cost is attached to a Work Order then received into inventory.

Sales Order Book - Sales Orders on the system. Takes place when a Sales Order with is attached to a Third Party Work Order. Once the Sales Order is invoiced and closed, the appropriate Journal Entries will be written.

Service Order - Normal service costs booked to work orders. Takes place when a Service Order with a Unit Cost is attached to a Work Order then received into inventory.

Tax - For applicable tax on a Work Order. Takes place when an order with a Tax Cost is attached to a Work Order then received into inventory. A Tax charge will only appear in the G/L if it is attached to a Work Order through an Exchange Order, Repair Order or Service Order.

Use drop down

Users may choose Production (for Hangar and Line Maintenance), Shop, S/O, Rental Order, Exchange Out or All to pick from the types of maintenance the Work Order is affected by for each transaction. This drop down filters for individual transactions. Only the transactions of the chosen features will appear (if 'All' is selected, all will appear). Certain Uses will be defaulted depending on the Category Code selected.

Description

Description of Category and related Category Code.

G/L

The General Ledger account(s) reference used for financial control throughout the system.

_____________________________________________________________________________________

Note: Notice the list of transaction accounts that appear (ex. Expense, Sales, etc.). These appear automatically because any transaction involving the specified Journal Entry Expenditure Category will affect the transaction types presented in this list. These transaction types are hard coded into the system. Select into any of the G/L fields to choose from a list of pre-defined codes. Here you will choose from the list of General Ledger accounts that were created in the General Ledger Accounts set up process. See the Setting Up General Ledger Accounts for the G/L Interface section of this manual for additional information regarding the setting up of G/L Accounts.

Depending on the functionality used within the system, the Journal Entries will be written for the accounts specified.

Share

Share

Print

Print