Share

Share

Print

Print

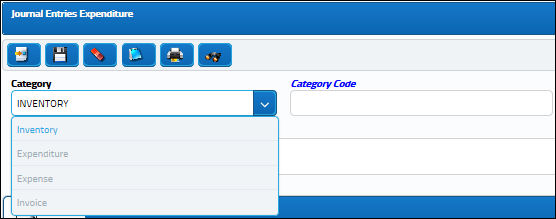

Journal Entries Expenditure

The Journal Entries Expenditure option is used to define how the General Ledger codes will be affected (debited or credited) by transactions that are performed within the system. The Journal Entry Expenditure Categories include:

Each Journal Entry Expenditure Category will be associated with a Category Code to create a Journal Entry Expenditure Category/ Category Code combination. Each Journal Entry Expenditure Category/ Category Code combination will then be associated with specific General Ledger accounts. These General Ledger accounts will then be affected (debited or credited) by transactions performed within the system in the form of a set of Journal Entries. The Journal Entries are the data that are produced by the system's financial management capabilities.

Although the preexisting hard-coded Category Codes are available and can have their linked G/L Accounts configured, users also have the option of creating new Category Codes:

- Creating New Codes

Entering new codes here is different from entering new codes elsewhere in the system. To enter a new expenditure code:

1. Choose the Category

2. Manually type in a new Category Code

3. Click on the New

button. The General tab will appear so that you can input/edit the General Ledger accounts as required. (See below)

button. The General tab will appear so that you can input/edit the General Ledger accounts as required. (See below) - Configuring Existing Codes

If you want to edit the G/L accounts that are associated with an existing Journal Entry Expenditure Category/Category Code combination:

1. Choose the Category

2. Click into the Category Code field. The list of pre-defined Category Codes will appear to choose from. Select one.

3. Select the Find

button. The General tab will appear so that you can input/edit the General Ledger accounts as required. (See below)

button. The General tab will appear so that you can input/edit the General Ledger accounts as required. (See below)

Notice the list of transaction accounts that appear (ex. Credit, Freight, etc.). These appear automatically because any transaction involving the specified Journal Entry Expenditure Category will affect the transaction types presented in this list. These transaction types are hard coded into the system.

Select into any of the G/L fields to choose from a list of pre-defined codes. Here you will choose from the list of General Ledger accounts that were previously set-up in the General Ledger Accounts option. See the Setting Up General Ledger Accounts for the G/L Interface section of this manual for additional information regarding setting up G/L accounts. Depending on the functionality used within the system, the Journal Entries will be written for the accounts specified.

Complete the required fields and any additional fields desired. Select the Save ![]() button. The instructions for creating each Journal Entry Expenditure Category/Category Code combination are described in the following section.

button. The instructions for creating each Journal Entry Expenditure Category/Category Code combination are described in the following section.

Relevant information can be added through the Notes ![]() button and related reports can be generated through the Print

button and related reports can be generated through the Print ![]() button.

button.

This update window is also available in query mode where users can view the records provided in this window but cannot create new records or edit existing data. Refer to this module's Query menu.

Share

Share

Print

Print