Share

Share

Print

Print

Monthly Financial Procedure - Running Fixed Asset Depreciation

The Fixed Asset Depreciation should be run monthly to automatically depreciate a company's Fixed Asset Registry. Depreciating a company's Fixed Asset Registry allows the company's F/A value to be up-to-date. The Fixed Asset depreciation must be done before Inventory Costing. See the Monthly Financial Procedure - Running Inventory Costing, of this manual, for further details.

Before the process, confirm that each Fixed Asset that will be affected by the task has depreciation parameters set up. Default depreciation time is set against each Part Number in the Settings module, along with residual value figures. Depreciation is ‘Straight Line’ only (although other possibilities, such as 'accelerated', could be provided via system modification). Refer to the Setting Default Depreciation For Parts section of this manual for more information regarding this.

Serialized parts are registered on the Fixed Asset file upon their Purchase or P/N Initial Load into the system. Parts that are sold or scrapped from the system are no longer registered as a company's Fixed Asset and therefore no longer contribute to the Fixed Asset Registry's monthly depreciation.

Each item has its own Fixed Asset record which can be viewed (and/or modified with required security) at any time during its life in the system. Comprehensive valuations are produced using this information so deletions and edits should be strictly controlled (through user security/access).

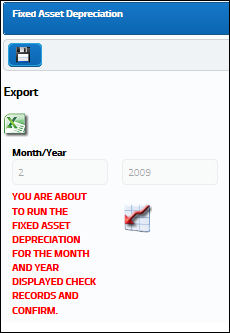

To run the task of Depreciation, go to G/L / Update/ Fixed Asset Depreciation. Select the Save ![]() button to run the Depreciation for the selected Month and Year.

button to run the Depreciation for the selected Month and Year.

Only select personnel should have access to this menu item to run the task. Select the Exit button to close the window without running the depreciation. Running the task will cause all applicable Part Numbers to be depreciated immediately.

Depreciation should be run every month. Running the option more often will not overrun on depreciation. If required, it can be run every quarter, according to an individual company's policy.

When depreciation occurs, Journal Entries are written to the relevant file for the associated amounts (these are rolled back if an item is scrapped or sold) until the depreciation is completed.

The depreciation calculation may take some time (depending on the number of items involved). Once the task is run, the new pricing will appear in the Fixed Asset record.

To view the new (depreciated) values, go to G/L Interface/ Update/ Fixed Asset Registry. For more information please refer to Fixed Asset Registry section of this manual.

Note: As an alternative to the inventory monthly parameters, users can organize their inventory closings by periods. This functionality is based on G/L Interface Switch ![]() INVBALPERIOD being set to Yes. When set to Yes, the Inventory Costing and Balance prints refer to the pre-determined date Periods created in the Inventory Balance Periods window instead of the months if the year. When set to No, the Inventory Costing and Balance prints refer to the months of the year instead of Periods. For more information refer to Switch

INVBALPERIOD being set to Yes. When set to Yes, the Inventory Costing and Balance prints refer to the pre-determined date Periods created in the Inventory Balance Periods window instead of the months if the year. When set to No, the Inventory Costing and Balance prints refer to the months of the year instead of Periods. For more information refer to Switch ![]() INVBALPERIOD via the G/L Planning Switches Manual and the Inventory Balance Periods window via the G/L Interface Training Manual.

INVBALPERIOD via the G/L Planning Switches Manual and the Inventory Balance Periods window via the G/L Interface Training Manual.

Share

Share

Print

Print