Share

Share

Print

Print

A 'DEPRECIATION' takes place when a component is depreciated only when a Fixed Asset Depreciation is run.

Note: The system performs depreciation only via the Straight Line Depreciation Method.

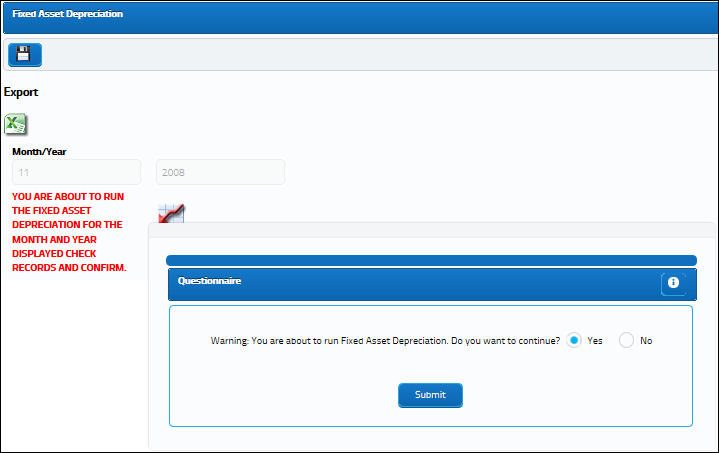

The Fixed Asset Depreciation method must be performed by administrators. This option is found via G/L Interface/Update/Fixed Asset Depreciation. From that window select the Save ![]() button. All P/Ns for the date setting will be depreciated by selecting 'OK'.

button. All P/Ns for the date setting will be depreciated by selecting 'OK'.

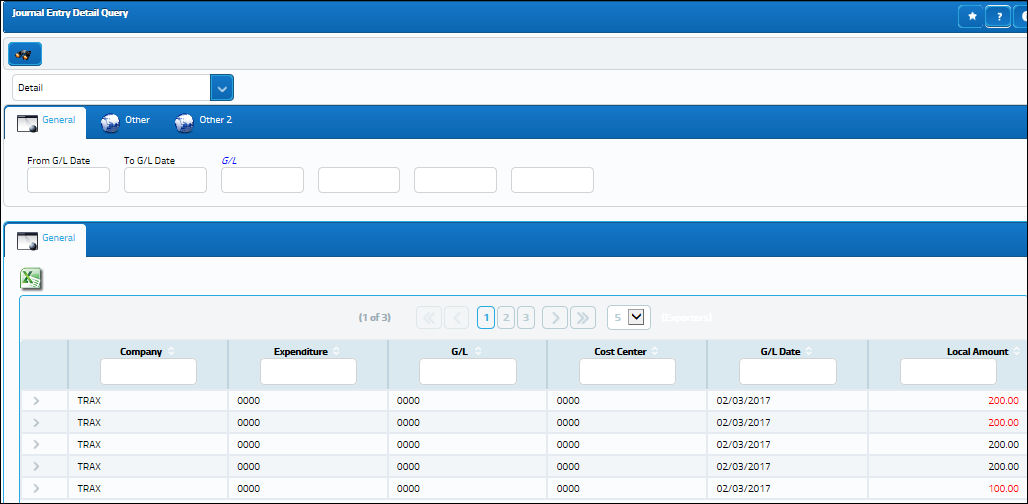

From the Journal Entry Detail Query window, users can see the adjustments against the G/L.

Notice the Category Codes read 'DEPRECIATION'.

For more information regarding the depreciation of a part, refer to the topics Running Fixed Asset Depreciation and Running a Month End Closing.

Share

Share

Print

Print