Share

Share

Print

Print

F/A Depreciation Code

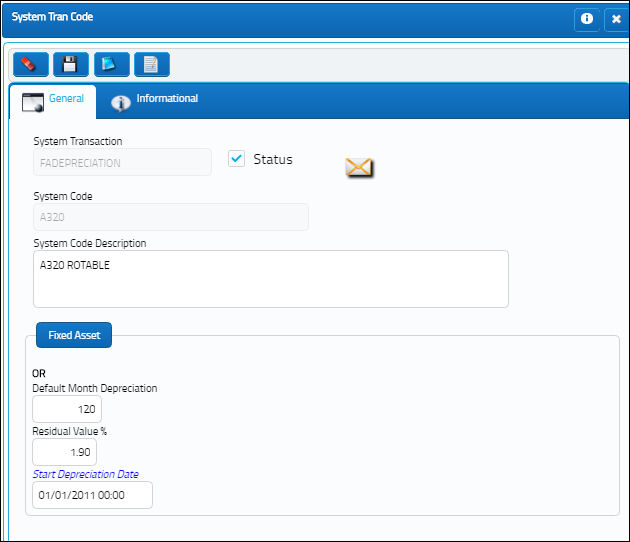

The System Transaction Codes are displayed with both the Code Names and Descriptions. The Code Descriptions directly illustrate their functionality and role in the system, as fields are populated and tasks are performed.

Transaction Code: |

FA Depreciation Code |

General Description: |

Fixed Asset Depreciation Code for a particular component. This information overrides any default depreciation previously set up for the particular part. |

Are Authorization Steps Available? |

N |

Is System Notification Available? |

N |

Control Panel Paths: |

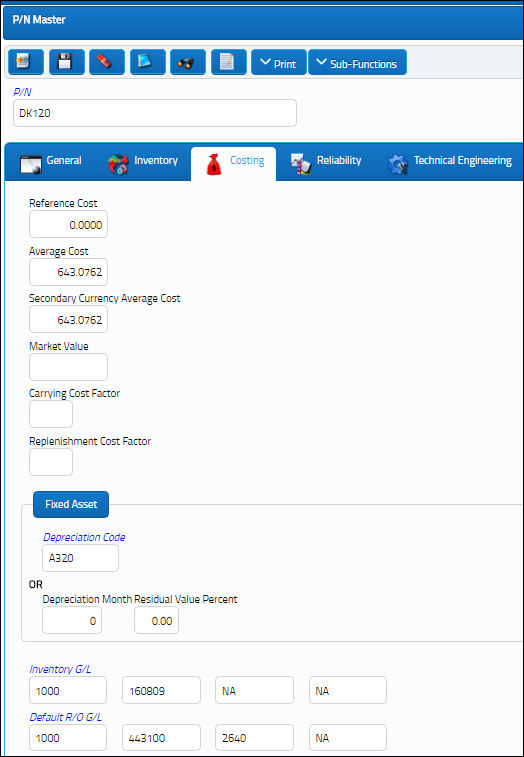

Settings/ Update/ P/N/ Costing Tab |

Window(s) |

w_pn_master_eu |

Related Switches: |

None |

Functions: |

Defines the different depreciation codes available in the system. These codes will be assigned to a part number and this determine the value and the depreciation of the parts. |

Reports: |

None |

Additional Functionality:

The F/A Depreciation Code can be applied to P/N Categories to override that Category's depreciation settings. The F/A Depreciation Code can also be applied manually to individual Part Numbers (instead of for all P/Ns of a particular P/N Category). Parts with this P/N Category or F/A Depreciation Code will then be depreciated according to the configuration of the F/A Depreciation transaction code.For example, when the Depreciation Code is inserted against a P/N Category, the Depreciation Month and Residual Value % fields are overridden by those values in the Depreciation Code. If that Depreciation Code also contains a Start Depreciation Date, then that field will also be applied to the P/N Category.

Because the F/A Depreciation Code contains the Start Depreciation Date field, this transaction code is necessary when utilizing the accelerated depreciation method. For more information refer to Accelerated vs Straight Line Depreciation.

The following fields can be configured through this transaction code.

The following information/options are available in this window:

_____________________________________________________________________________________

Default Month Depreciation

The number of months required for the Fixed Asset value of these parts to be depreciated over (i.e., five year depreciation is 60 months). This number can be defaulted for parts based on the P/N Category or F/A Depreciation Code, or it can be overridden manually at the part level in the P/N Master, Costing Tab.

Residual Value %

The residual value of the part that remains after the depreciated month has completed (expressed as a percentage of the actual cost of the Fixed Asset). This percentage can be defaulted for parts based on the P/N Category or F/A Depreciation Code, or it can be or overridden manually at the part level in the P/N Master, Costing Tab.

Start Depreciation Date

The specific date that the Fixed Asset will start depreciating from. This field is only available from the Depreciation Code and is typically used for the accelerated depreciation method. The straight line depreciation method would depreciate from the fixed asset's creation date (i.e., the part's purchase date or initial load date), and would therefore not rely on this start date. For more information refer to Accelerated vs Straight Line Depreciation.

_____________________________________________________________________________________

But from the P/N Master, Costing tab, this transaction code can be manually assigned to an individual Part Number.

Share

Share

Print

Print