Share

Share

Print

Print

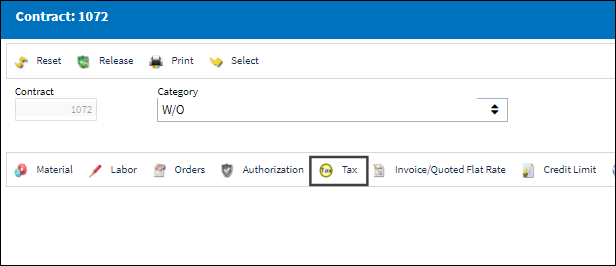

The Tax ![]() button allows users to add Value Added Tax (VAT) percentages to the total cost of the work. These taxes will be applied to the total after all other configurations and rules are applied to the work.

button allows users to add Value Added Tax (VAT) percentages to the total cost of the work. These taxes will be applied to the total after all other configurations and rules are applied to the work.

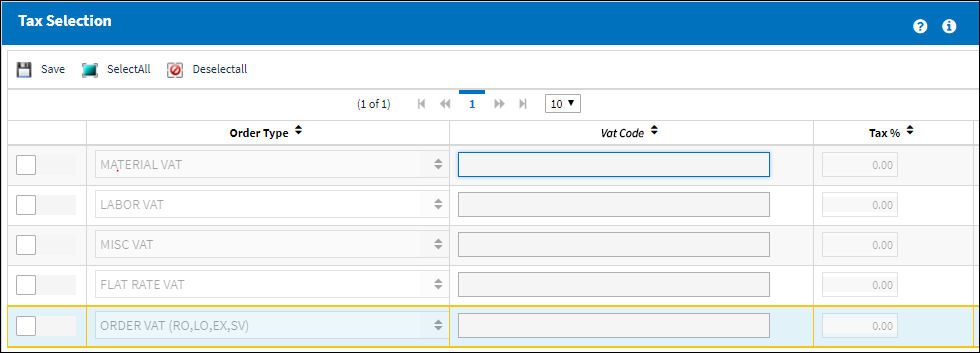

The Tax Selection window appears.

The following information/options are available in this window:

_____________________________________________________________________________________

Order Type

The type of tax rate being applied.

Vat Code

Allows the user to add a Value After Tax percentage to the order. This is set up through the VAT Code System Tran Code. Entering this code automatically populates the Tax Percentage field.

Tax %

The percentage being taxed for the VAT Code. This field is automatically populated, but it can be edited.

Description

A description of the tax being applied.

_____________________________________________________________________________________

Share

Share

Print

Print