Share

Share

Print

Print

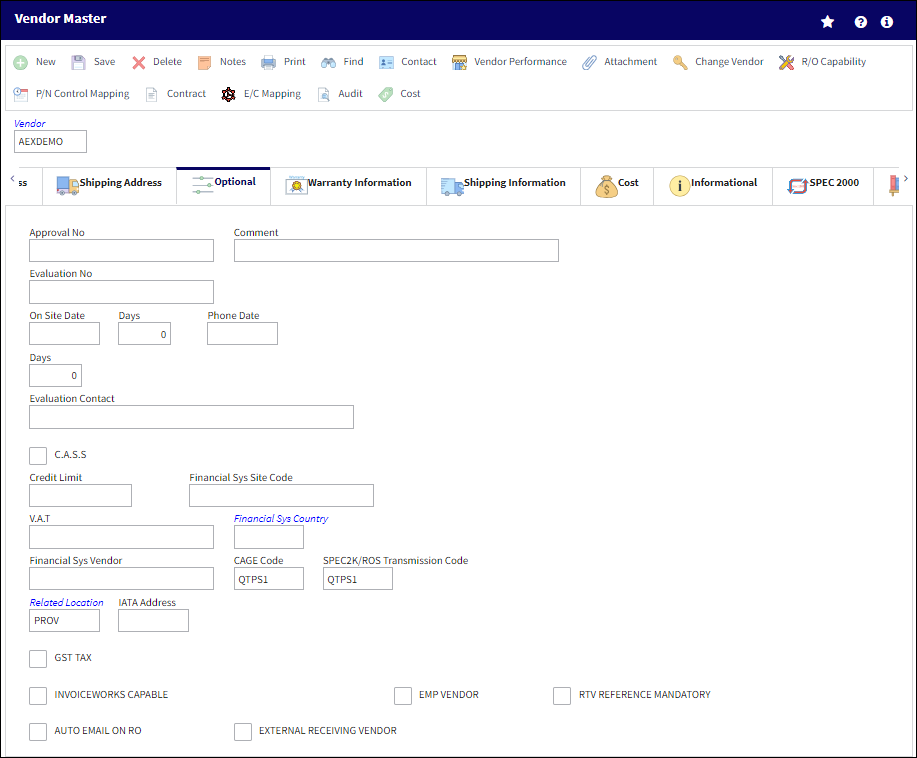

Vendor Master, Optional Tab

The system displays the Vendor Master, Optional tab as follows:

The following information/options are available in this window:

_____________________________________________________________________________________

Approval No

Company Vendor Approval number.

![]() Note: This field caps at 25 characters.

Note: This field caps at 25 characters.

Comment

Comment text.

Evaluation No

Company Vendor Evaluation number.

![]() Note: This field caps at 25 characters.

Note: This field caps at 25 characters.

On Site Date

Date of on-site evaluation.

Days - Days to next evaluation.

Phone Date

Date of next phone evaluation.

Days - Days between phone evaluations.

Evaluation Contact

Contact person at Vendor site.

CASS checkbox

Check this box to indicate a Continuous Analysis and Surveillance System.

Credit Limit

Financial credit limit for Vendor.

V.A.T.

Allows the user to add a Value After Tax percentage to the order. This is set up through the VAT Code System Tran Code.

Financial Sys Vendor

The corresponding Vendor code from the third party company financial system.

ROS Shipment Carrier

Enter ROS Shipment Carrier name. This is informational only.

Financial Sys Site Code

The order's financial system site code.

Financial Sys Country

The country code for the corresponding Vendor on the company financial system.

Related Location

The name of a related location to associate with this vendor.

CAGE Code

The Commercial and Government Entity (CAGE) standardized supplier code. This is a government-issued, five character code used to identify suppliers/vendors for each of their unique locations.

IATA Address

The International Air Transport Association (IATA) Code of the carrier for air shipments.

GST checkbox

Select the Goods and Services Tax (GST) checkbox to apply a tax percentage to Orders throughout the system for the selected Vendor. When selected, the following field will appear:

Percentage - The percentage to be taxed for orders involving the selected Vendor.

G/L Account - The General Ledger account that is affected when an order is taxed.

For more information, refer to Goods and Services Tax (GST) Functionality via the Settings Manual.

InvoiceWorks Capable checkbox

Indicates that the vendor is able to use the InvoiceWorks XML format for sending out Purchase Orders.

Note: This checkbox is selected automatically when a new Vendor is created with a Vendor Category that has the InvoiceWorks Capable checkbox selected via the Vendor Category Transaction Code. For more information refer to the Settings Transaction Code Manual.

LHT Vendor checkbox

Select this checkbox to have this vendor recognized as an LHT vendor.

![]() This checkbox is part of the LHT interface functionality and is only available for customers using this interface. For more information refer to the LHT Interface (TCS) manual.

This checkbox is part of the LHT interface functionality and is only available for customers using this interface. For more information refer to the LHT Interface (TCS) manual.

EMP Vendor checkbox

Select this checkbox to have this vendor recognized as an Essential Maintenance Provider vendor. This checkbox is informational only.

RTV Reference Mandatory checkbox

Select this checkbox to make the RTV Reference field in the Return to Vendor, General Tab mandatory. For more information refer to the Return to Vendor button.

Auto Email on RO checkbox

Select this checkbox to have the system automatically send an email when a Repair Order is authorized. The Email field, via Vendor Master, Mailing Address tab must be populated with a valid email address. If there is no email address in the Vendor Master, Mailing Address tab, once the RO is authorized, a warning message will appear.

External Receiving Vendor checkbox

Select this checkbox to determine an Actual Received date upon Order Receiving. The Actual Received Date will act as the Customs Received Date. All financial transactions and the exchange rate will be based on this date. For example, if the user enters an Actual Received Date of 10/10/2012, once the PO has been received, the correct Currency Exchange Rate will be reflected in the Inventory Detail History Transaction, General tab based on the exchange rate on 10/10/2012. Selecting this checkbox will trigger the following pop up message at Order Receiving:

For additional information, refer to the Order Receiving, General Tab, via the Receiving Training Manual.

_____________________________________________________________________________________

Share

Share

Print

Print