Share

Share

Print

Print

Select a part number and click on the Find ![]() button. Choose the desired record. Click on the Select

button. Choose the desired record. Click on the Select ![]() button. Select the Accounting tab.

button. Select the Accounting tab.

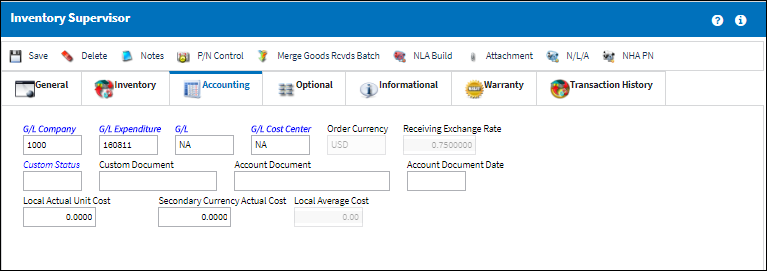

The Inventory Supervisor Detail, Accounting tab displays General Ledger, costing, and currency related information associated with the part. Unlike the Inventory Transaction, here in the Supervisor the user may update the G/L information.

The following information/options are available in this window:

_____________________________________________________________________________________

G/L Company

The General Ledger account that is affected when an order is taxed.

G/L Expenditure

The Expenditure Code for the G/L Account.

G/L

The General Ledger account(s) reference used for financial control throughout the system.

G/L Cost Center

The Cost Center for the G/L Account.

Order Currency

The order currency code.

Receiving Exchange Rate

Exchange rate that applies when the part is received.

Custom Status

Customs status that applies to the part in the transaction, as applicable.

Custom Document

Customs document that applies to the part.

Account Document

The name of the related accounting document.

Account Document Date

The date the related accounting document was submitted.

Local Actual Unit Cost

The cost for the individual part.

Secondary Currency Actual Cost

The cost for the individual part.

Local Average Cost

The Average Cost of the Part in local currency, which is re-calculated upon receipt of inventory from Purchases, Invoice Adjustments (if there is a difference between PO Price and INV Price), and Return to Stock (which is unknown inventory returned at average cost or credited to the Work Order, differing the P/N Cost from the Average Cost).

The explanation for the formula is as follows:

(The total number of Unit Costs currently in Inventory) / (The total of all quantities currently in inventory). For example, if you have three parts in inventory for a certain P/N (three parts including all possible instances of the part [available in inventory, available for repair etc.]). And the unit costs on each part are $10, $15, and $20 each. If all information has been entered properly, the current Average cost would be calculated as (10 + 15 + $20) / 3) = $15. Expanding on the example, if you receive a new same part at $18, the current Average cost would re-compute as follows: ($10 + $15 + $20 + $18) / (3 + 1) = 15.75.

_____________________________________________________________________________________

Share

Share

Print

Print