Share

Share

Print

Print

Invoice Additional Fees

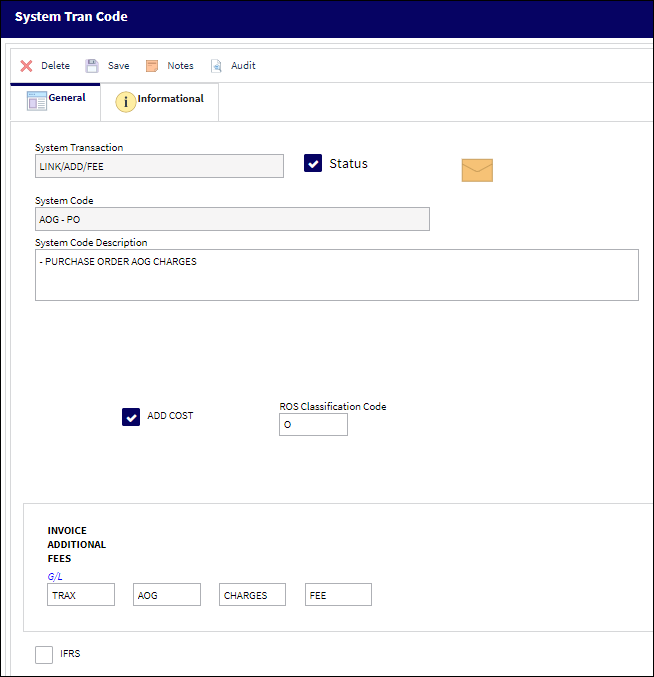

The System Transaction Codes are displayed with both the Code Names and Descriptions. The Code Descriptions directly illustrate their functionality and role in the system, as fields are populated and tasks are performed.

![]() The Invoice Tax Transaction Code is security controlled via Settings/ Explorer/ System Transaction Codes/ Link/ Invoice Additional Fees. For additional information, refer to the Security Explorer, via the System Administration Training Manual.

The Invoice Tax Transaction Code is security controlled via Settings/ Explorer/ System Transaction Codes/ Link/ Invoice Additional Fees. For additional information, refer to the Security Explorer, via the System Administration Training Manual.

Transaction Code: |

Invoice Taxes |

General Description: |

Add taxes to an invoice. |

Are Authorization Steps Available? |

N |

Is System Notification Available? |

N |

Control Panel Path(s): |

Link/ Update/ Invoice Entry/ invoice Order Detail/ New Button |

Windows(s): |

w_invoice_order_eu |

Related Switch(s): |

None |

Functions: |

|

Reports: |

None |

Available Functionality:

The Invoice Additional Fees transaction code is used to add additional fees as line items to invoices. The secondary function of the Code is to auto populate the G/L Code specified in the Transaction Code in the Invoice Order Detail window. When opened, the the following fields are available.

The following information/options are available in this window:

_____________________________________________________________________________________

Status checkbox

When selected, the Additional Fee option is displayed in the New Invoice Item window of the Invoice Order Detail window. If not selected, the word Status is listed in red and the Additional Fee option is not displayed in the New Invoice Item window.

Add Cost checkbox ![]()

This checkbox works in conjunction with the Add Cost and Add Cost Type fields in the Purchase Order and Exchange Order detail windows. When an additional cost is added to an order through the Add Cost field and linked to one of these transaction codes through the Add Cost Type field, when the order is invoiced and a New line item is added for the order's additional cost, the added cost is automatically populated in the new invoice line item if the tran code's Add Cost checkbox is selected. If not selected, the cost field for the new invoice line item will be 0.00 and must be entered manually.

For more information refer to the New Button, via Invoice Order Detail of the Link Training Manual.

ROS Classification Code ![]()

When the MANDATORY Property checkbox is selected, the ROS Classification Code auto populates to M. The field becomes protected and the user cannot change this ROS Classification Code unless the MANDATORY Property checkbox is deselected. When a new ECMANDATORY Transaction Code is created, the ROS Classification Code will default to O. This is a free text field, however only the following codes are acceptable for use at this time:

M - Mandatory

O - Optional

D - Improvements

R - Recommended

![]() The ROS Classification Code and subsequent functionality is a customized configuration and may not be available for your company. For additional information, consult the appropriate Interface Administrator.

The ROS Classification Code and subsequent functionality is a customized configuration and may not be available for your company. For additional information, consult the appropriate Interface Administrator.

G/L

Enter the G/L code that corresponds to the Additional Fee. Whenever this Additional Fee is added in the Invoice Order Detail window, the corresponding G/L is added to the invoice.

IFRS checkbox

When selected, the International Financial Reporting Standards (IFRS) proration calculations are implemented for Duty and/or Freight as well as any Invoice Taxes and Invoice Additional Fees charges made against a Purchase Order's line items at time of invoicing. For detailed information, refer to the IFRS Functionality via the Link Training Manual.

_____________________________________________________________________________________

When the New ![]() button of the Invoice Order Detail window is selected, the Additional Fees checkboxes appear in the New Invoice Item pop-up window.

button of the Invoice Order Detail window is selected, the Additional Fees checkboxes appear in the New Invoice Item pop-up window.

For more information refer to the New Button, via Invoice Order Detail in the Link Training Manual.

Share

Share

Print

Print