Share

Share

Print

Print

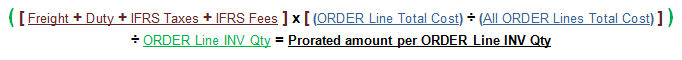

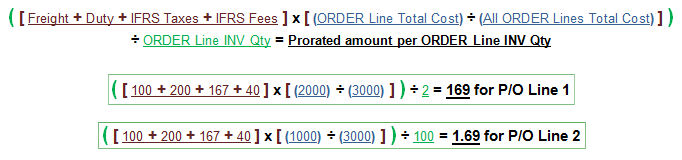

In compliance with the International Financial Reporting Standards (IFRS), the IFRS functionality allows users to apply a prorated calculation to each invoiced part based on the Purchase Order Line item they were ordered through. By applying the IFRS checkbox to Link transaction codes, the total cost of all IFRS freight and duty as well as IFRS taxes and fees are prorated and added to the value of each Purchase Ordered part once invoiced. This prorated invoice calculation is performed through a formula that is applied to each of the order's Line items. The resulting prorated amount is then added to the value of each invoiced part for each specific order Line item. The following is the IFRS purchase order proration formula used for P/Os during the invoicing process:

Refer to the following process for details on how the IFRS functionality is set up and how the proration formula is applied.

Note: In order for the IFRS functionality to properly affect an invoiced part's Fixed Asset records, the Invoice must be sent to Released status before being Closed. Invoices can be sent to Released status only when Link Switch ![]() APINCLST-RL is set to Yes. Refer to the below for details on how to send an invoice to Released status. For more information refer to Switch

APINCLST-RL is set to Yes. Refer to the below for details on how to send an invoice to Released status. For more information refer to Switch ![]() APINCLST-RL via the Link Switches Manual.

APINCLST-RL via the Link Switches Manual.

Note: Users can create unique Invoice header entries for each cost associated to an order. These unique invoices will all affect the ordered part's F/A Value (even if additional linked Invoice Headers are posted after the ordered part's unit cost was invoiced). For more information refer to the IFRS Functionality via Invoice Header.

Link Transaction Code Setup:

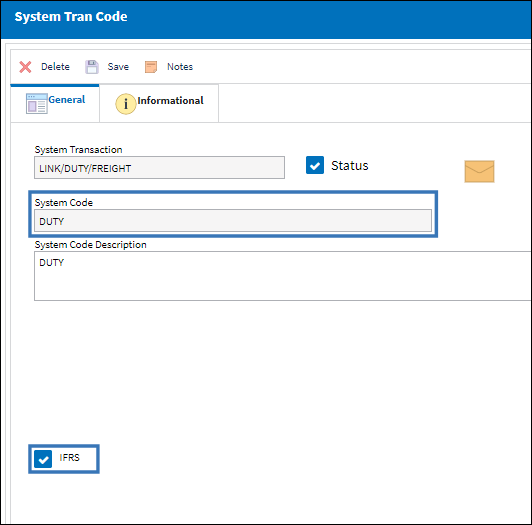

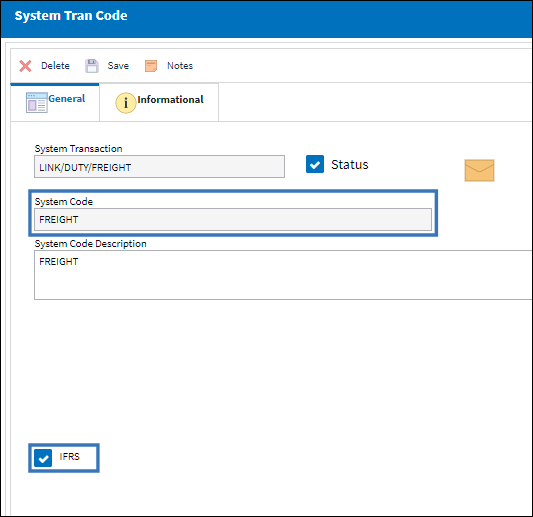

First, notice that the following Invoice Duty/ Freight IFRS Setup transaction codes (DUTY and FREIGHT) have the IFRS checkbox selected for each.

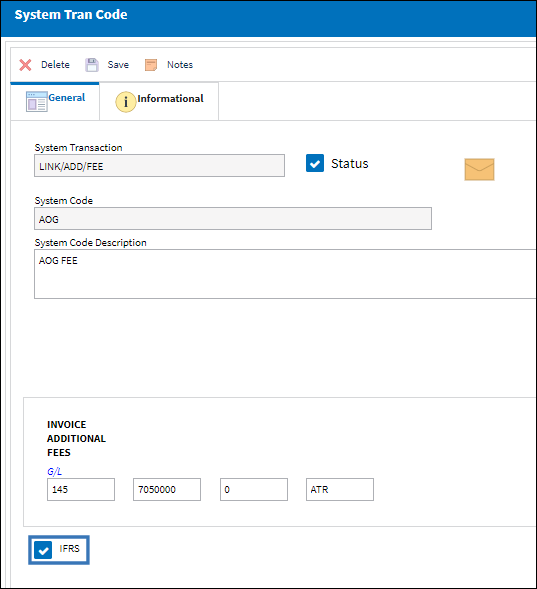

The following Invoice Additional Fees tran code, AOG, has the IFRS checkbox selected.

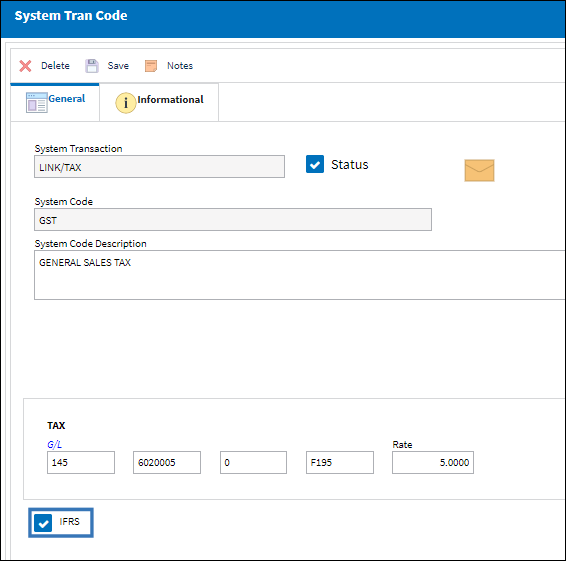

The Invoice Tax tran code, GST, also has the IFRS checkbox selected. Because it's a Tax, the Rate to the left of the checkbox will be applied.

Note: Only those invoice fees and taxes that have the IFRS checkbox selected will be prorated once invoiced. The Link Transaction Codes that have the IFRS available are Invoice Additional Fees, Invoice Tax, and Invoice Duty/ Freight IFRS Setup. For more information refer to the Link Transaction Code Manual.

Once all of the transaction codes are set up, a Purchase Order can be created and invoiced.

Order Creation:

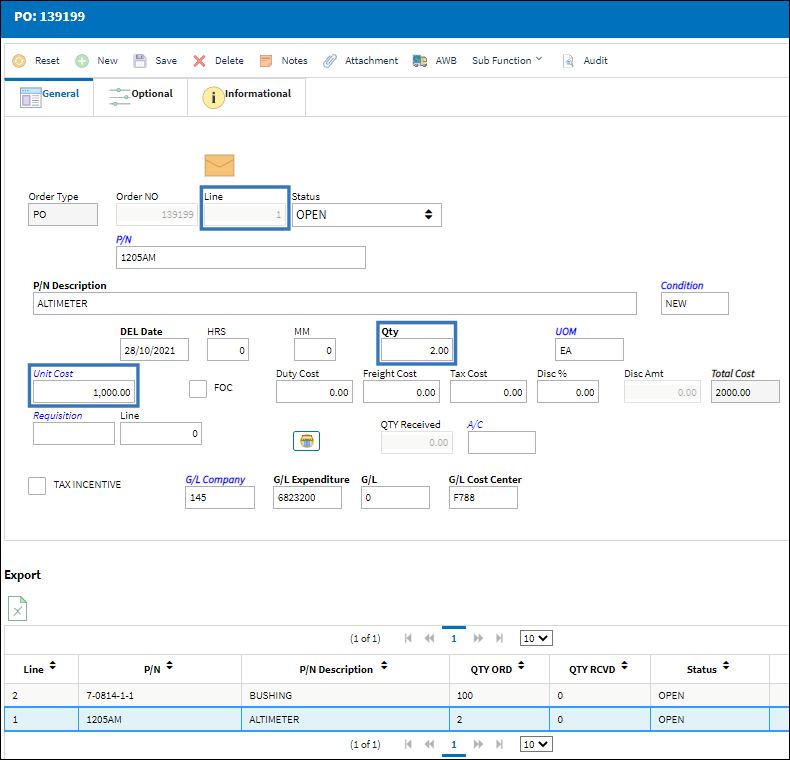

The following Purchase Order is created with two Line items. The first Line item is for 2 serialized parts that cost $1,000 each.

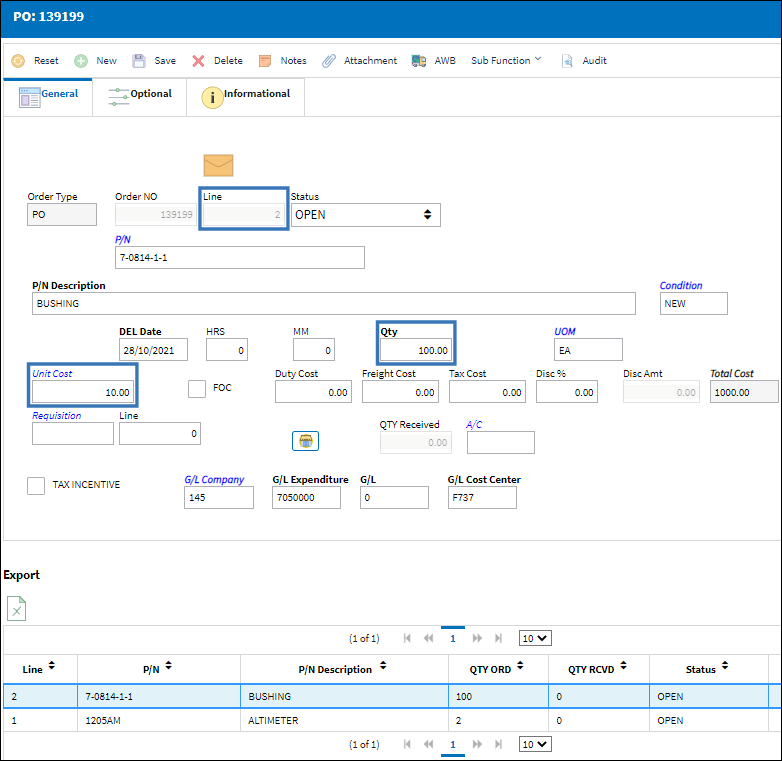

The second Line item is for 100 expendable parts that cost $10 each.

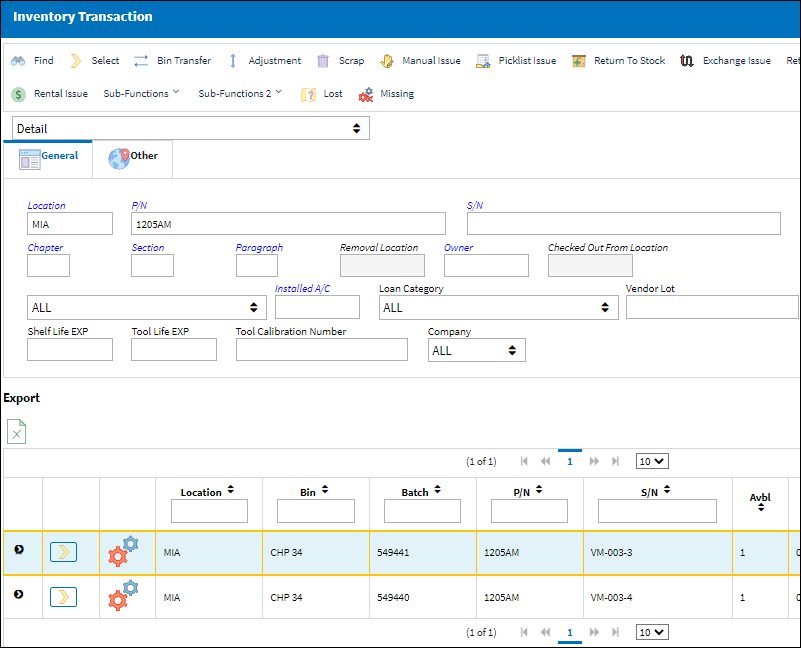

Each of the two serialized parts from P/O Line item 1 are received into inventory.

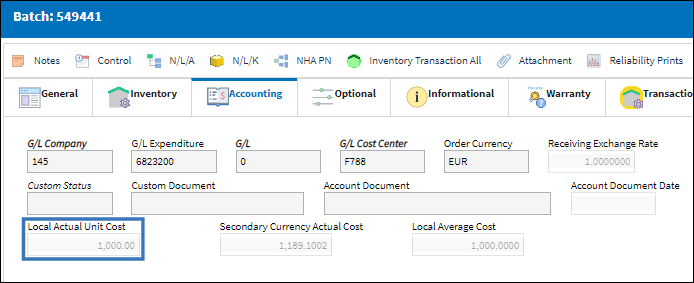

Each of the two serialized parts from P/O Line item 1 have an Actual Unit Cost of $1,000.

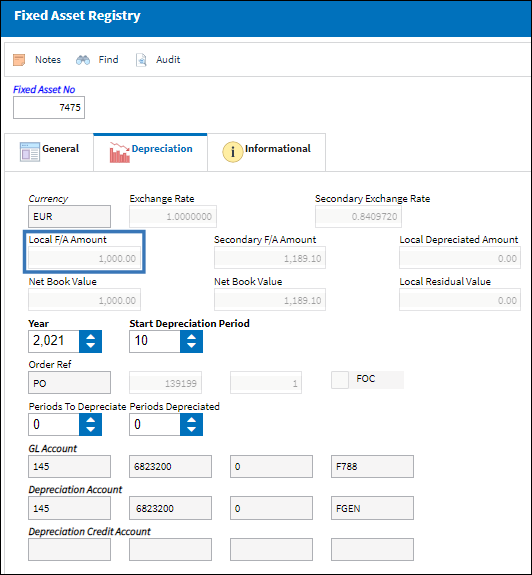

Fixed Assets are created for each of the received serialized parts. Each of the two serialized parts have a Local F/A Amount of $1,000.

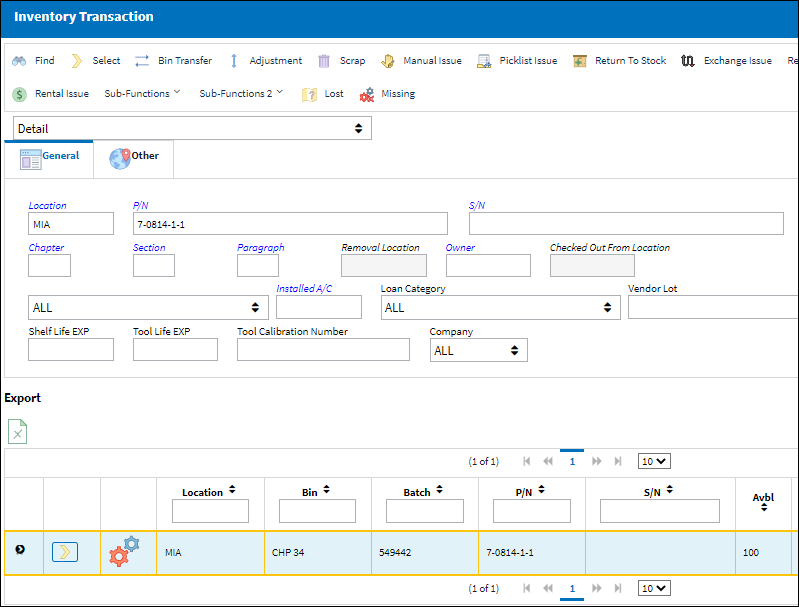

The expendable parts from P/O Line item 2 are also received into inventory.

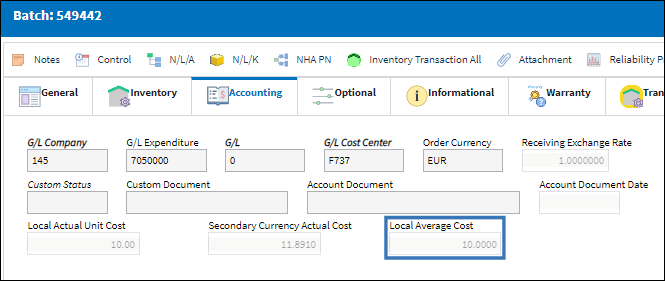

The expendable parts each have a Local Average Cost of $10.

IFRS Invoicing Process:

When the Purchase Order is invoiced, the P/O's Line items are invoiced as follows.

At this point, the following Invoice items are added to the invoice: Invoice Additional Fee (AOG), Invoice Taxes (GST), and the Invoice Duty/Freight items (Duty and Freight).

Notice that the FREIGHT, DUTY, GST, and AOG fees have been applied to the invoice. The FREIGHT and DUTY fees are zero since they were not added through the Purchase Order.

Note: If the FREIGHT fees are added to the Purchase Order, they will automatically cascade down to the Invoice Order Detail. Otherwise, they can be manually added/overridden in the Invoice Order Detail window.

The AOG fee is also set to zero. The GST tax is automatically populated because it is reflecting the 5% tax rate of the invoice's original Calculated Total. (5% of $3,000 = $150; New Calculated Total is $3,150) The tax rate of 5% comes from the Invoice Tax transaction code, GST.

The FREIGHT, DUTY, and AOG fees are manually added to the invoice. Notice that the GST tax is automatically updated to reflect the updated Calculated Total (5% of $3,340 = $167 ; new Calculated Total = $3,507). The FREIGHT, DUTY, and GST are set to Hold status and sent to authorization once the invoice is saved.

From the Invoice Authorization Management window, each of the invoice fees are accepted.

Once authorized, from the Invoice Order Detail window, the Invoice is saved again and automatically sent to Released status.

Note: The invoice is only sent to Released status when Link Switch ![]() APINCLST-RL is set to Yes. For more information refer to the Link Switches Manual.

APINCLST-RL is set to Yes. For more information refer to the Link Switches Manual.

The Release status invoice is then saved in the Invoice Release Selection window.

Once saved, the invoice is set to Closed status.

At this point, Journal Entries are created for the Purchase Order invoice.

IFRS Formula:

Because the invoice for the P/O contained invoice items with the IFRS checkbox applied, the IFRS proration formula is applied to the parts ordered through the Purchase Order.

Note: Only those invoice fees and taxes that have the IFRS checkbox selected will be prorated.

The formula is set up and applied as follows:

The prorated totals for each P/O Line item are added to each parts' Unit Cost. For instance, the following is one of the two serialized parts ordered through the P/O Line item 1.

The IFRS prorated amount for the part has been added to its original Local Actual Unit Cost. The Unit Cost went from $1,000 to $1,169.

This is the second of the two serialized parts ordered through the P/O Line item 1.

The same IFRS prorated amount was added to this P/N S/N because it was ordered through the same P/O Line item.

Note: These IFRS fees were automatically prorated into the Cost of the parts because these parts were brought into the system through a Purchase Order. If they were entered through any other order type, the IFRS fees would not have been prorated into the parts' Costs. When entered not through Purchase Orders, the additional IFRS fees are invoiced separately from the part's Cost.

The Fixed Asset record for each P/N S/N was also updated with the IFRS prorated amount. The following is the first P/N S/N from P/O Line item 1.

Notice its Local F/A Amount has also been updated to $1,169.

This is the second P/N S/N from P/O Line item 1.

Its Local F/A Amount has also been updated to $1,169.

The following are the 100 expendable parts ordered through the P/O Line item 2.

Notice that the IFRS prorated amount for P/O Line item 2 has been added to the P/N's Local Average Cost. It was updated from $10.00 to $11.69.

Share

Share

Print

Print