Share

Share

Print

Print

As an alternative to the IFRS Proration Functionality, IFRS can be captured through multiple invoice entries that can be tied to the Purchase Order's total invoiced cost. In order to capture the total cost of an inventory item - including its Purchase Order Unit Cost and any applicable Taxes, Duty, and Freight fees - additional IFRS functionality will reflect this total cost in the purchased item's Fixed Asset or Average Cost. Actual Cost components ('serialized', 'repairables', etc.) will have their Fixed Asset record reflect this cost, while Average Cost components ('consumables', 'expendables', etc.) will have the part's Average Cost value adjusted accordingly.

These P/O values are captured through multiple invoice entries in the Link module. These entries ('Tax', 'Duty', and 'Freight' transaction codes with the 'IFRS' checkbox selected) are all tied to the Purchase Order.

The system's classic IFRS functionality requires that all fees be linked to the order at the same time (via Order Detail entries). However, by creating new invoice entries for each charge linked to the order, users can link fees to a part's total cost even after the P/O has been invoiced. For example, if a freight forwarder sends a bill for their handling of the order several weeks after the order was invoiced, the freight fee can be input as a unique Invoice and linked to the P/O (via an Invoice Header entry) that will retroactively update the ordered part's F/A amount.

Example:

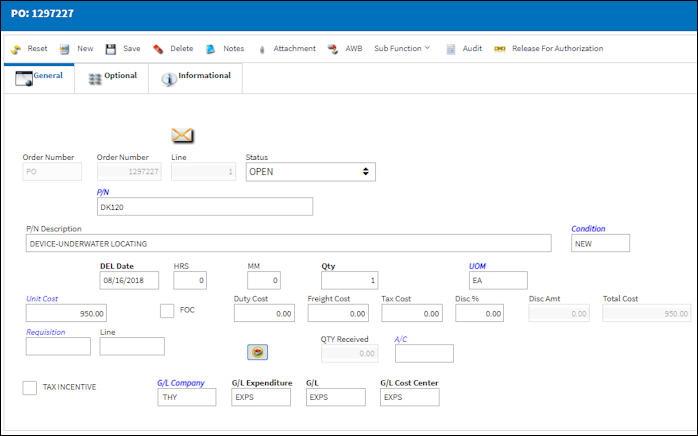

For example, notice the following part is ordered through a Purchase Order. The Unit Cost of the part is '950.00.'

Note: This component is a serialized part. Its Actual Cost will be reflected in a Fixed Asset Record.

Once received, notice the Fixed Asset was registered for P/O's '950' Unit Cost.

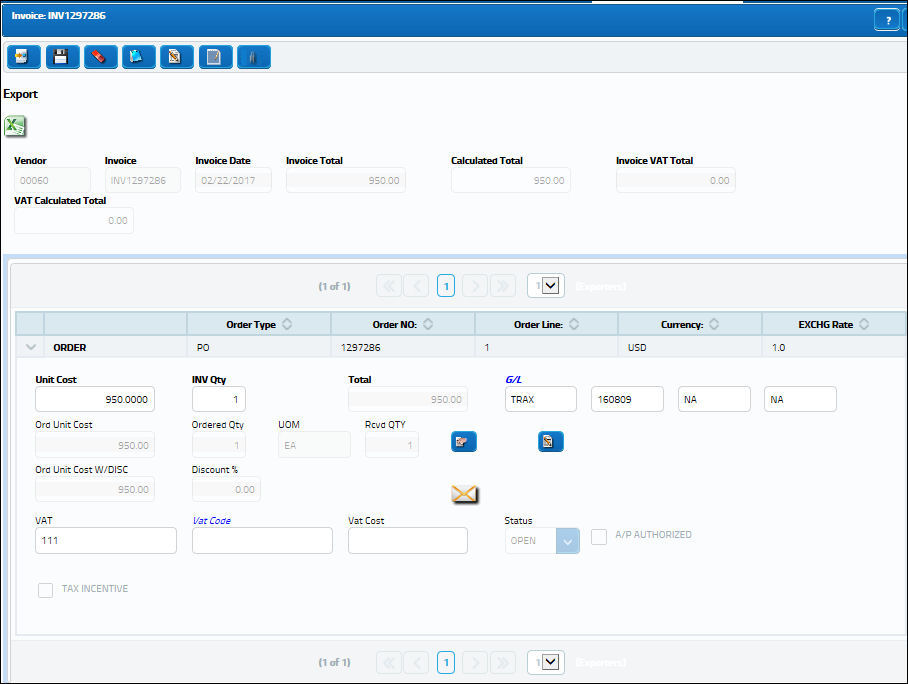

The Unit Cost is then invoiced.

To apply a Tax to the Fixed Asset, first go to the Link transaction codes. Under the Invoice Taxes tran code, open the 'TAX' code and select the IFRS checkbox.

Then create a new invoice with the Invoice Category set to 'Tax'. Insert the tax amount in the Invoice Amount field and enter the P/O number. Then create and release the invoice.

To apply a Duty fee to the Fixed Asset, first go to the Link transaction codes. Under the Invoice Duty/Freight IFRS Setup tran code, open the 'DUTY' code and select the IFRS checkbox.

Then create a new invoice with the Invoice Category set to 'Duty'. Insert the duty amount in the Invoice Amount field and enter the P/O number. Then create and release the invoice.

To apply a Freight fee to the Fixed Asset, first go to the Link transaction codes. Under the Invoice Duty/Freight IFRS Setup tran code, open the 'FREIGHT' code and select the IFRS checkbox.

Then create a new invoice with the Invoice Category set to 'Freight'. Insert the freight amount in the Invoice Amount field and enter the P/O number. Then create and release the invoice.

Once all invoices are posted, the Fixed Asset record is adjusted accordingly.

Now the F/A for the ordered part includes the P/O Unit Cost ('950.00'), the Tax ('66.50'), the Duty ('30.00'), and the Freight ('24.00'). The updated F/A total is '1070.50.'

If the ordered part was for a consumable/expendable part that is based on the Average Cost costing method, then the part's Average Cost would be updated accordingly to reflect the part's total IFRS cost (P/O Unit Cost, Tax, Duty, and Freight).

Share

Share

Print

Print