Share

Share

Print

Print

VAT Code

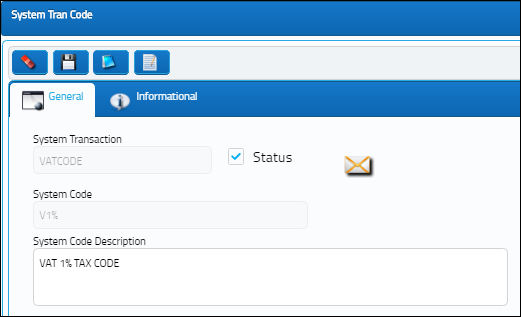

The System Transaction Codes are displayed with both the Code Names and Descriptions. The Code Descriptions directly illustrate their functionality and role in the system, as fields are populated and tasks are performed.

Transaction Code: |

Vat Code |

General Description: |

Add taxes to an invoice. |

Are Authorization Steps Available? |

N |

Is System Notification Available? |

N |

Control Panel Path(s): |

Link/ Update/ Invoice Entry/ invoice Order Detail |

Windows(s): |

w_invoice_order_eu |

Related Switch(s): |

None |

Functions: |

|

Reports: |

None |

Available Functionality:

The VAT Transaction Code is used to add a percentage of tax to an invoice. The secondary function of the Code is to auto populate the G/L Code specified in the Transaction Code in the Invoice Order Detail window.

The following information/options are available in this window:

_____________________________________________________________________________________

Status

Select the Status checkbox to have the specified Transaction Code in Active status. When this checkbox is deselected, the Transaction Code will be Inactive.

G/L

The General Ledger accounting code for the order.

Rate

Enter the percentage of the rate of tax.

Note: The VAT Cost of the Order Invoice line item is calculated from the percentage Rate to contribute to the VAT Calculated Total of the Invoice. In previous versions, the VAT Calculated Total would be calculated through manually adding a new separate line item for the VAT Code.

IFRS checkbox

When selected, the International Financial Reporting Standards (IFRS) proration calculations are implemented for Duty and/or Freight as well as any Invoice Taxes and Invoice Additional Fees charges made against a Purchase Order's line items at time of invoicing. For detailed information, refer to the IFRS Functionality via the Link Training Manual.

_____________________________________________________________________________________

Share

Share

Print

Print