Share

Share

Print

Print

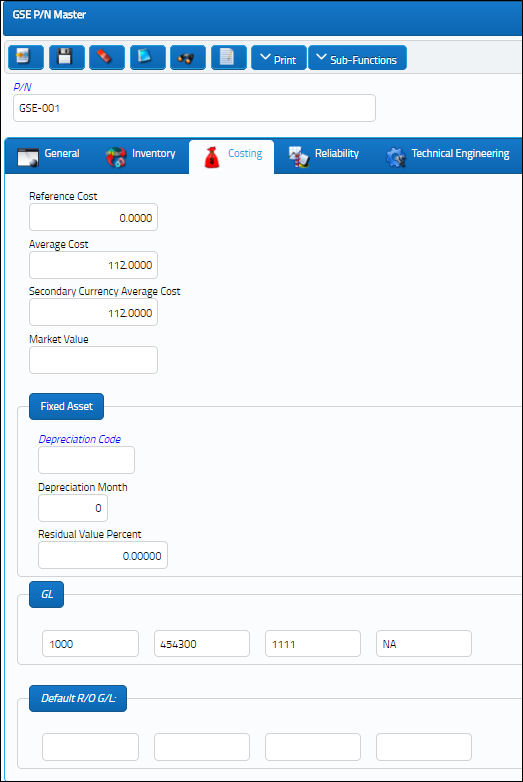

GSE P/N Master, Costing Tab

The Costing Tab identifies the various types of costing associated to this GSE part. The only fields in which you should enter information are Reference Cost and Market Value. Reference Cost is a standard amount the part may cost you on a regular basis. Market Value is the average Market Value if you wish to sell or identify the average value. Average Cost and Secondary Average Cost should not be adjusted. These fields will adjust automatically with each Order Receiving Transaction based upon a calculation used in the program. Your Finance Department should determine the Fixed Asset value. In most cases they are usually predefined in the System Transaction Codes for the Part Category Type for this part then overridden as required.

The following information/options are available in this window:

_____________________________________________________________________________________

Reference Cost

The Part's reference cost.

Note: This field functions in accordance with the Switch ![]() PNREFCST. If set to Yes, the system will compare the Part Number Reference Cost to the PO unit cost. If there is a difference the user will receive a prompt asking if they would like to update the Part Number Reference Cost (P/N Master, Cost Tab) with the PO Unit Cost.

PNREFCST. If set to Yes, the system will compare the Part Number Reference Cost to the PO unit cost. If there is a difference the user will receive a prompt asking if they would like to update the Part Number Reference Cost (P/N Master, Cost Tab) with the PO Unit Cost.

Average Cost

The Average Cost of the Part in local currency, which is re-calculated upon receipt of inventory from Purchases, Invoice Adjustments (if there is a difference between PO Price and INV Price), and Return to Stock (which is unknown inventory returned at average cost or credited to the Work Order, differing the P/N Cost from the Average Cost).

The explanation for the formula is as follows:

(The total number of Unit Costs currently in Inventory) / (The total of all quantities currently in inventory). For example, if you have three parts in inventory for a certain P/N (three parts including all possible instances of the part [available in inventory, available for repair etc.]). And the unit costs on each part are $10, $15, and $20 each. If all information has been entered properly, the current Average cost would be calculated as (10 + 15 + $20) / 3) = $15. Expanding on the example, if you receive a new same part at $18, the current Average cost would re-compute as follows: ($10 + $15 + $20 + $18) / (3 + 1) = 15.75. For adjustments to this figure, refer to the 'P/N Average Cost Movement' topic.

Note: The Average Cost functionality works in accordance with Switch ![]() RTSCOST. If this switch is set to No, then inventory returned to stock is re-averaged for unknown inventory.

RTSCOST. If this switch is set to No, then inventory returned to stock is re-averaged for unknown inventory.

Secondary Currency Average Cost

The average cost for the part in your secondary currency.

Market Value

The cost of replenishing inventory. The formula for replenishing stock compares forecast stock usage against available stock throughout the coming year. Existing replenishment orders are also considered since these affect future requirement needs.

Note: The data in the three cost fields are populated based on system calculation of costs of purchased parts.

Fixed Asset section

The Fixed Asset section allows users to view and modify Fixed Asset Depreciation parameters for individual parts. This information is populated by default from the properties configured in the P/N Category transaction code but the information can be overridden for specific P/Ns from this tab. For more information refer to Setting Default Depreciation for Parts via the G/L Interface Training Manual.

Depreciation Code - The Fixed Asset Depreciation transaction code linked to this P/N Category or P/N record (via P/N Master, Costing tab). When a Depreciation Code is entered, the Default Month Depreciation and Residual Value % fields will be overridden by that code's configuration. The Depreciation Code also contains the Start Depreciation Date field (which is used as part of the Accelerated depreciation method). This code can be defaulted for parts based on the P/N Category or manually overridden at the part level in the P/N Master, Costing Tab. For more information refer to the F/A Depreciation Code transaction code.

Depreciation Month - The number of months required for the Fixed Asset value of these parts to be depreciated over (i.e., five year depreciation is 60 months). This number can be defaulted for parts based on the P/N Category or F/A Depreciation Code, or it can be overridden manually at the part level in the P/N Master, Costing Tab.

Residual Value Percent - The residual value of the part that remains after the depreciated month has completed (expressed as a percentage of the actual cost of the Fixed Asset). This percentage can be defaulted for parts based on the P/N Category or F/A Depreciation Code, or it can be or overridden manually at the part level in the P/N Master, Costing Tab.

Note: The G/L code is automatically derived from the setup of the P/N Category (Settings/Explorer/System Transaction Code/Settings/P/N Category) that is associated with this part and can be overridden if required.

G/L

This sets the General Ledger account reference for this part. It also allows reporting of inventory values by G/L accounts. The G/L code will populate fields such as in a P/O for the Part. When a part is received from a P/O, the value of that receipt will be attributed to the G/L account specified in the P/O.

Default R/O G/L

If the part is associated with a Repair Order, this G/L will be affected.

_____________________________________________________________________________________

Share

Share

Print

Print