Share

Share

Print

Print

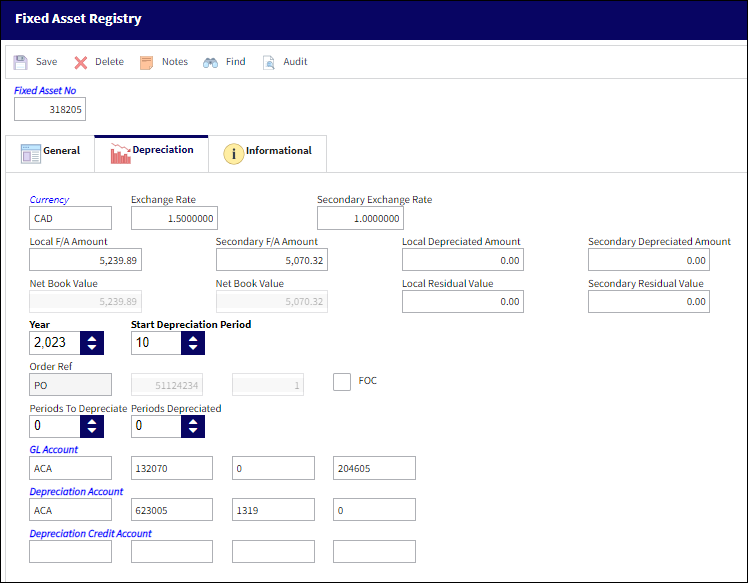

Fixed Asset Registry, Depreciation Tab

The Depreciation tab stores specific information regarding how the Fixed Asset will be depreciated by the system. If the depreciation program has been run (G/L /Update/Fixed Asset Depreciation), then the system will calculate depreciation values and place those values on this tab. The starting month for the depreciation, the number of months to depreciate, and the number of months that have been depreciated are maintained (along with the associated values).

The following information/options are available in this window:

_____________________________________________________________________________________

Currency

The currency the item value is held in.

Exchange Rate (Dual currency)

The current exchange rate to company standard currency.

F/A Amount (Dual currency)

The Total Fixed Asset amount.

Depreciated Amount (Dual currency)

The current depreciated amount to date.

Net Book Value

This value represents the difference between the F/A Amount and the Depreciated Amount. (Formula used: 'F/A Amount' - 'Depreciated Amount' = 'Net Book Value') This field is informational only and cannot be edited.

Residual Value (Dual currency)

The residual value of the item.

Start Depreciation

The month/ year that depreciation will begin. Will default to current.

Months To Depreciate

The total number of months to depreciate the value over.

Note: For more information on the relationship between the F/A Depreciation Code and the P/N Category transaction codes refer to the P/N Category via the Settings Transaction Code Manuals.

Months Depreciated

The current number of months the part has already depreciated.

G/L Account

The G/L Account that is associated with the part on this Fixed Asset record.

Depreciation Account

The G/L account that depreciation values are applied to when the Fixed Asset Depreciation task is run.

Depreciation Credit Account

When a user creates a fixed asset manually, a credit account has to be assigned to the Fixed Asset record. This account is credited and debited in the Journal Entries query once the F/A record is created.

![]() Note: When a new Fixed Asset is received into the system, a trigger will automatically insert the Depreciation G/L found in the Journal Entries Expenditure window into the Depreciation Credit Account field.

Note: When a new Fixed Asset is received into the system, a trigger will automatically insert the Depreciation G/L found in the Journal Entries Expenditure window into the Depreciation Credit Account field.

Note: This field is only available, and mandatory, when G/L Switch ![]() FACREDITNEW is set to Yes.

FACREDITNEW is set to Yes.

Order Reference

The order that created the Fixed Asset in the system.

FOC checkbox

Indicates whether or not the FOC (Free of Charge) checkbox was selected in the order that created this Fixed Asset Registry. This checkbox can be overridden from this window: it can either be selected or deselected. When deselected, the F/A Amounts can be populated manually.

Further, when selected, the field is displayed in red text.

This information will also appear in the Fixed Asset Registry Query and the Fixed Asset Registry Query Print.

_____________________________________________________________________________________

Note: The values in these fields can be edited as necessary.

The default values that are used for depreciation can be set via Settings/Explorer/System Tran Code/Setting/ P/N Category.

Share

Share

Print

Print