Share

Share

Print

Print

The Import ![]() button allows users to upload a .xlsx file that will automatically create multiple Service Order Detail lines upon a successful import.

button allows users to upload a .xlsx file that will automatically create multiple Service Order Detail lines upon a successful import.

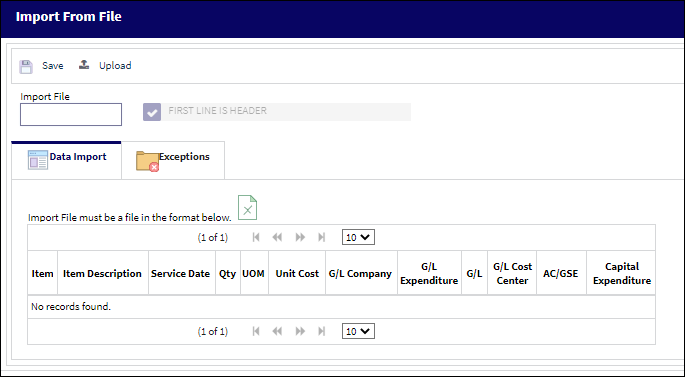

Selecting the Import ![]() button displays the Import from File window.

button displays the Import from File window.

The following information/options are available in this window:

_____________________________________________________________________________________

Save ![]() button

button

Select this button to save the imported T/C headers into the system.

Upload ![]() button

button

Select this button to import the desired .xlsx file.

Import File field

This field will populate the name of the file that has been imported.

First Line Is Header checkbox

Select this checkbox to ensure that the first line of the imported document is recognized as the T/C Header.

Item

The name of the Line Item being imported.

Item Description

The description of the Line Item.

Service Date

The service date associated with the Line Item.

Qty

The number of parts/items associated with the record.

Unit Cost

The unit cost from the vendor (per UOM specified). Select into the field for historical purchase costs. The cost information is derived from the P/N Master (Settings/ Update/ P/N Master/ Cost button). See the Settings chapter for additional information regarding the P/N Master.

G/L Company

The associated parent company for the G/L Account.

G/L Expenditure

The Expenditure Code for the G/L Account.

G/L

The General Ledger account(s) reference used for financial control throughout the system.

G/L Cost Center

The Cost Center for the G/L Account.

AC/GSE

The ground service equipment associated with the related aircraft.

Capital Expenditure

The Capital Expenditure code describes the way in which a cost is to be accounted for.

_____________________________________________________________________________________

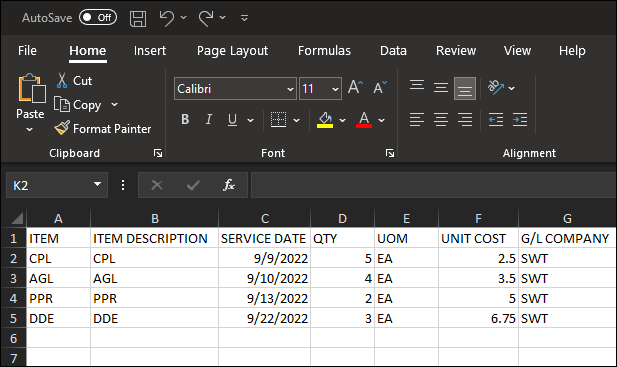

Users can select the file ![]() button to access the appropriate template.

button to access the appropriate template.

Note: If the G/L Company column is empty in the import file, the system will pull the associated G/L from the Service Master. However, if there is no G/L within the Service Master for the associated item, an exception will be generated.

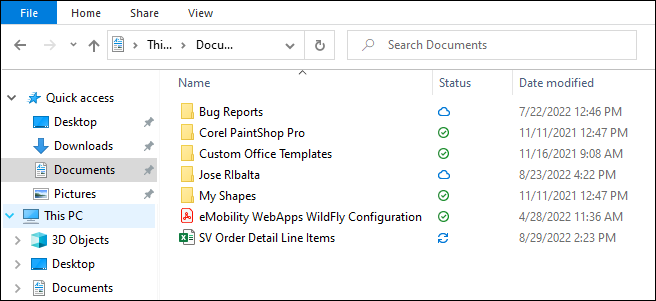

Once the file is populated with the desired information, the user can select the Upload ![]() button to begin importing the .xlsx file. The user's file explore displays.

button to begin importing the .xlsx file. The user's file explore displays.

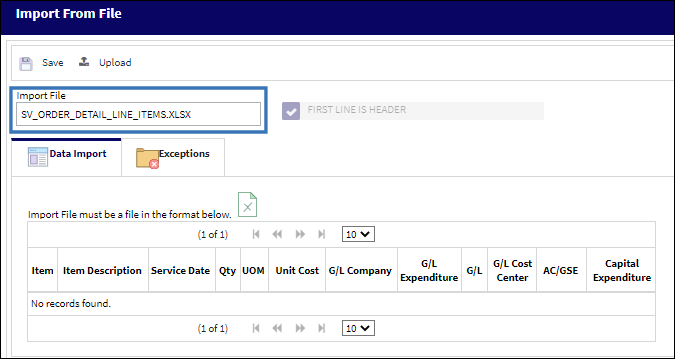

When the file is uploaded into the system, its name will appear in the Import File field.

Select the Save ![]() button to complete the import process.

button to complete the import process.

Share

Share

Print

Print