Share

Share

Print

Print

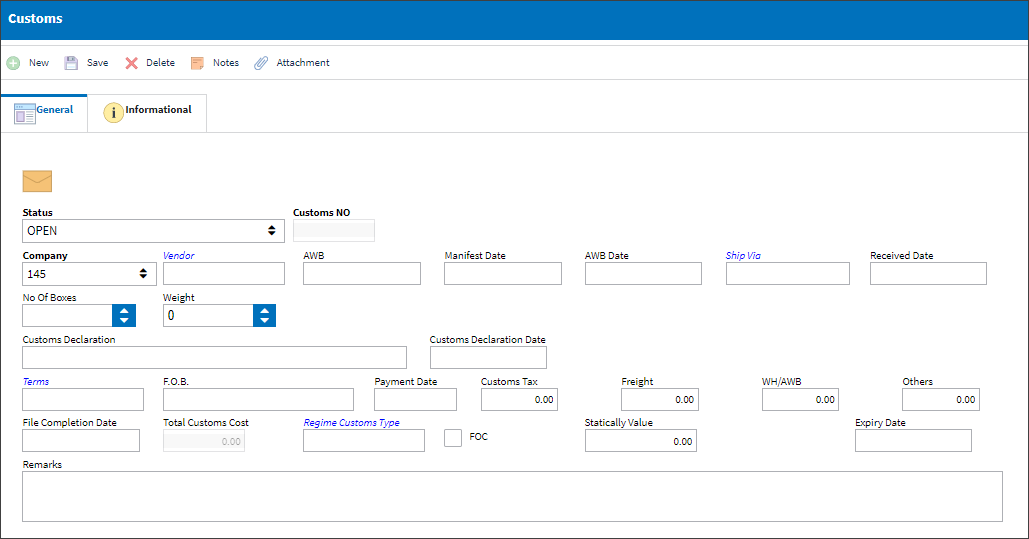

Customs Detail, General Tab

The Customs Detail, General tab allows the user to create a new Customs record or view details of previously created customs records and update information.

The Customs record is linked to an order through the AWB (Airway Bill) that tracks the delivery of the ordered part(s). For detailed information refer to Linking Orders to Customs Records via AWB.

The following information/options are available in this window:

_____________________________________________________________________________________

Status

The current status of the customs record. The options are Open or Closed; Open is selected by default. To close the record this Status must be manually set to Closed and then saved.

Customs NO

The unique system identification number for the Customs record. This number is applied automatically once the record is created.

Company ![]()

The Company linked to the order and its related customs charge.

Vendor

The system code for the service/part provider. The third party brokerage vendor that is clearing the order through customs.

AWB

The AWB is the official document issued by the carrier that contains the order's freight details. This number links the Customs record with Orders in the system. The AWB is pivotal for tracking the Customs process all the way through the invoicing process. To link this AWB to an order, go to that order's detail window then select the AWB/Expedite ![]() button.

button.

Manifest Date

The date that the process was started.

AWB Date

The date that the AWB was created.

Ship Via

The freight forwarder responsible for delivering the order to its destination.

Received Date

The date that the freight was received in the destination.

No Of Boxes

The number of boxes included in the delivery.

Weight - The weight of the delivered box(es).

Customs Declaration

The customs declaration number used to itemize the goods being brought into the country through customs procedures. This is a free text field and informational only.

Customs Declaration Date

The date of the Customs Declaration document.

Terms

The terms of payment, including the amount of days in which the payment must be made, may be defined by selecting from the pre-defined listing established in the System Transaction Codes. Terms may be changed for a particular order as required. For additional information, please refer to the Terms section of the System Trans Codes Training Manual.

F.O.B. ![]()

The Free On Board field (FOB) is used to enter Intercom codes which can be used to determine Customs transactions that require invoicing or transactions that are free of charge (FOC).

Payment Date

The tax's payment date.

Customs Tax

The tax associated to the customs process.

Freight

The associated freight cost/fees, if applicable.

WH/AWB

Fees associated to the Warehouse and Airway Bill.

Others

Any other associated fees. These fees would typically include the brokerage fees.

File Completion Date

The date that this Customs record was completed.

Total Customs Cost

The total fees for this record. This total cost is composed of the Customs Tax, Freight, WH/AWB, and Others fees.

Regime Customs Type ![]()

Customs regulations that define the status of goods and means of transportation. These are transaction codes set up as defined in Settings/ Explorer/ System Transaction Code/ Order/ Regime Customs Type.

FOC checkbox ![]()

Select the FOC checkbox if there are no associated custom fees.

Statically Value ![]()

The fixed cost of the custom fees.

Expiry Date ![]()

The date the customs declaration will expire.

Remarks

This field is used to enter additional information regarding this customs record. This is a free text field.

_____________________________________________________________________________________

Invoicing Customs Fees:

For detailed information on how Customs records are invoiced, refer to these topics:

- Customs Fees: Financial Tracking: How to create a Journal Entries and Link invoices for Customs records

- Customs Fees: Invoicing the Customer: How an MRO vendor can create Customer Invoices for the Customs records

Share

Share

Print

Print